Originally published on Forbes.com.

On June 22nd, 2012, Tesla introduced the Model S, which was at the time an innovative, electric vehicle (EV) employing the radical architecture of a consolidated, quasi-super-computer controlling fewer electrical modules, which allowed for Over-The-Air (OTA) updates to all of the software in the vehicle. Fewer servicing visits. New subscription-feature downloads. Lightning-fast cybersecurity patches. Unbeknownst to the world at the time, it birthed the now commonplace-yet-poorly-understood buzzphrase “Software-Defined Vehicle” (or SDV).

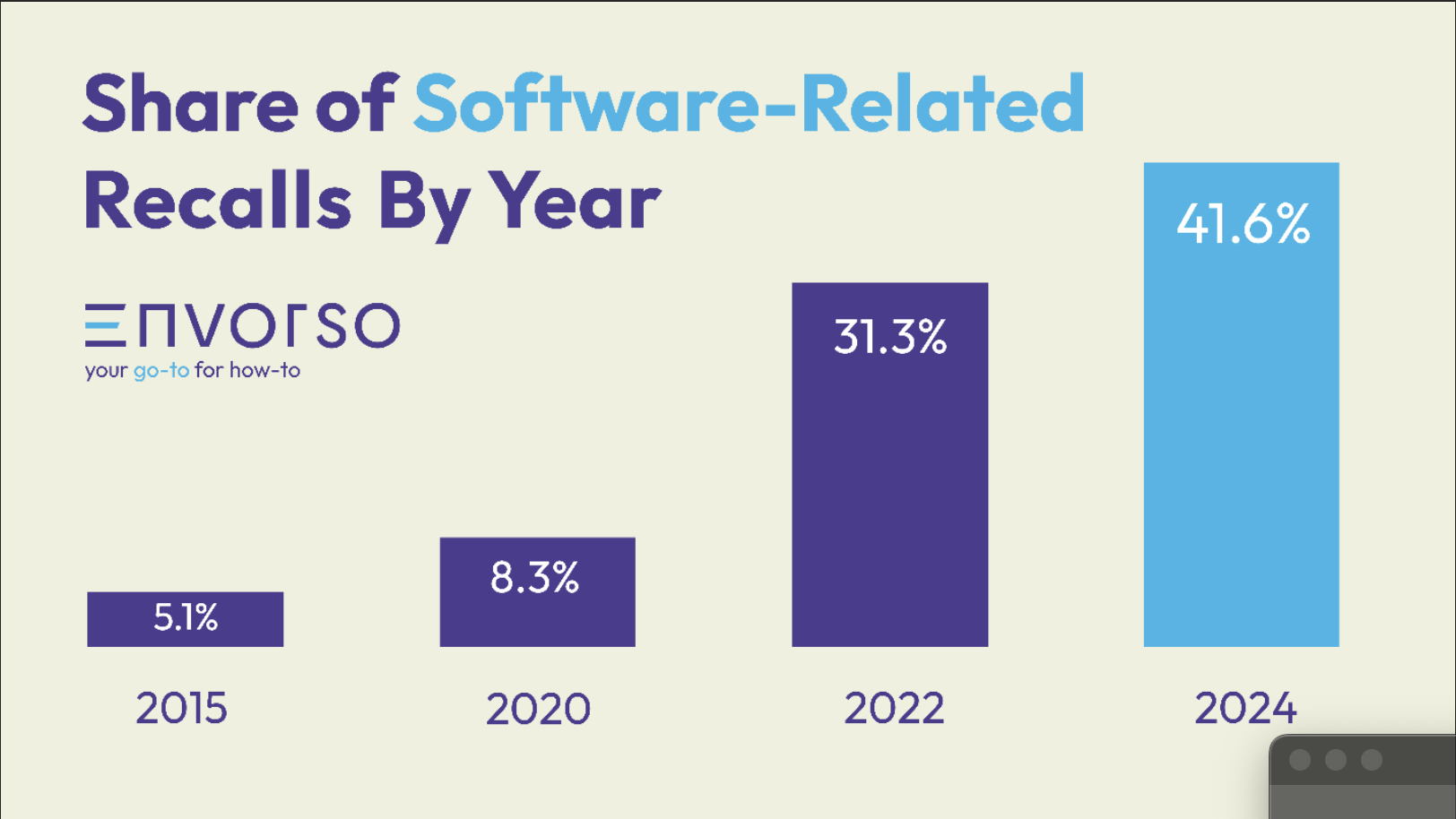

Now nearly thirteen (13) years later, few incumbent automakers have implemented such an architecture. Software-related recalls have hit an all-time high (42%), which is five-fold the percentage of such recalls just four years ago. And while several have theoretically-but-not-practically recognized the tremendous cost savings (e.g., multiple automakers spent between $4-11B USD on warranty in 2024 with the estimated development cost of a new vehicle being $6B USD), many executives (and journalists) question, “Why is it taking so long to re-engineer the solution?”

The unfortunate answers are various delays that have been thorny to manage within the global automotive climate: the complex overhauling, the unfortunate pairing, the investment tsunami, and the talent confusion.

JANUARY 2025: Per Todd Warren, a professor at Northwestern University, the number of software-related recalls have quintupled from 5.1% in 2015 to a record-breaking 41.6% in 2024; all during the age of the Software-Defined Vehicle (Infographic by A. Brink). – ENVORSO

The Complex Overhauling

Naïve inquisitors likely believe the change is “just software,” and cannot understand the complexity of switching.

“It’s a hard transition for these folks because they have existing platforms, which they have spent billions of dollars on and you are trying to retrofit,” says Sudipto Bose, Senior Director of the Automotive Business Unit at GlobalFoundries, a chipmaker that manufactures semiconductors for global OEMs. “But that’s like putting duct tape on the problem. This is a systems architecture issue that requires an overhaul of both the software and hardware. The software architecture that they’re envisioning is driving a whole new class of semiconductor devices because [today’s] chips were built … to enable dozens of disparate systems from various suppliers. The automakers now need to not only deal with just basic commands between modules, but also control more of the source code and the lower-level software.”

Such a radical change is difficult for any automaker that’s juggling multiple brands with several products on various continents. “The traditional automakers have so many models on the road with so many customers,” states Bose, “It’s not like they’re selling one car like Xiaomi or any Chinese start-up. [Xiaomi] came and built one car, and that’s the one car they’re selling so it’s easier for them to deploy.”

The Unfortunate Pairing

For many automakers, the path forward in 2013 became clear: investors want to see a Tesla-competitor for both the electric vehicle and the software-defined vehicle markets. Both competitive offerings required clean-slate architectures, and so began the pairing that seemed natural to directors managing the fleet mix: the new EV would launch the SDV platform.

However, several factors were unforeseen in the EV market. The consumers have been hesitant to buy EVs without incentives, e.g. the average price of a new EV in the U.S. last October was $56,902, which was 17% higher than an Internal Combustion Engine (ICE) vehicle. Charging points have been slow to rollout in some markets, especially (once again) the U.S. And with increased competition — approximately 100 EV manufacturers in China alone — and impending trade tensions, even the mighty Tesla saw sales drop 1.1% in 2024, which was Tesla’s first annual decline since 2011.

And so the delay of EVs became the accidental postponement of the Software-Defined architecture for several automakers.

The resultant tsunami from multiple large bets placed over the past few years is destroying the landscape of budgets and spending.

The Investment Tsunami

In the 2015-2019 timeframe, the acronym supposedly taking over the industry was CASE: Connected, Autonomous, Shared, and Electric. Many executives placed large bets on each of these transformative initiatives.

However, many such ventures have not panned out. For instance, General Motors invested $2B on OnStar, $10B on Cruise, $1B on Maven, and $35B on electric vehicles with only a few pockets of success across the various endeavors.

Such failed investments make additional investments more difficult both politically and financially. To quote Michael Wayland of CNBC, “The auto industry has an addiction. It’s a ‘capital junkie’ that’s been on a yearslong binge of unprecedented spending on all-electric and autonomous vehicles. And now, it’s waking up from the bender and entering rehab.”

The Talent Confusion

Imagine switching a company from creating widgets to doodads. Your talent understands widgets. Your management grew a career from mastering the intricacies of widgets when doodads were barely a thing.

But then doodads ate the world.

And grew orders of magnitude in a few short years.

That’s been the history of software in automotive. “Within these companies, they don’t have the right skill set yet, but they are recruiting a lot of people from outside,” reports Bose. “But they’re underestimating the effort. All of them are moving in the right direction, but the speed at which they initially thought that they’d move, start the program, and … actually start writing software … has been much slower.”

To make matters worse, Big Box consultants have whispered to CEOs about the need for Silicon Valley talent, but the cultural fit has been ineffective. As said best by Joann Muller of Axios, “[The] friction point is the tech sector likes to ‘move fast and break things,’ [while] cars need to be safe and high-quality. Reconciling the two imperatives isn’t easy.”

And the management responsible for such reconciling only understands widgets.

Stay ahead in a rapidly world. Subscribe to Prysm Insights,our monthly look at the critical issues facing global business.